Table Of Content

- How do I find out what my house is worth?

- My home is located in one of the areas covered, so why isn’t there a Redfin Estimate for it?

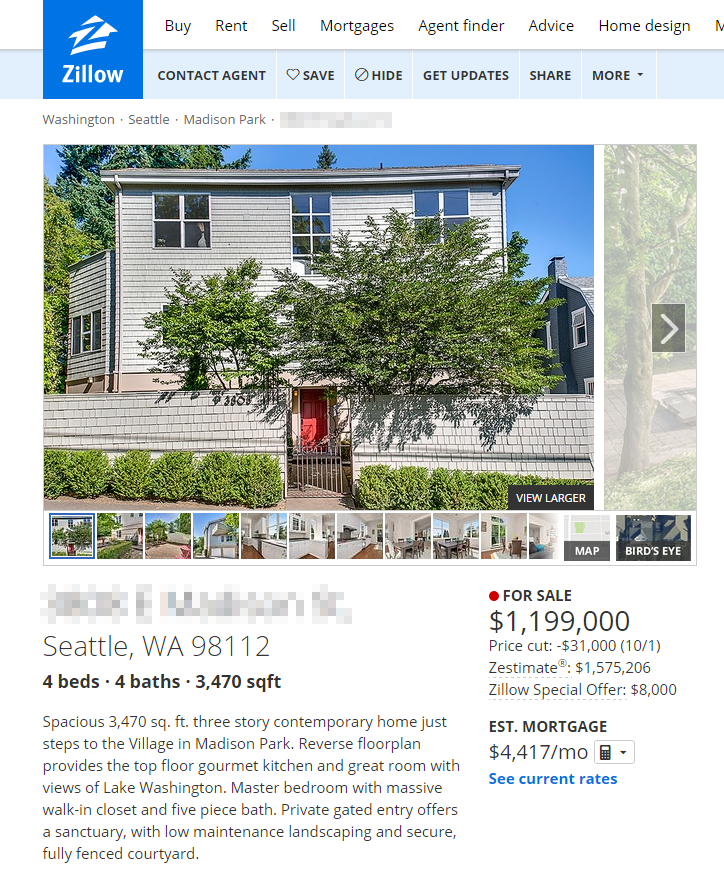

- How accurate are “zestimates” on Zillow?

- Why isn’t the Redfin Estimate accurate for my home?

- What information is used to calculate the Redfin Estimate?

- How much your home is worth

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Professional home appraisals consider various factors to determine a home’s value, including size, location, condition, upgrades and local comps (or what other, similar homes nearby have sold for). Mortgage lenders require an appraisal before they will approve your loan.

How do I find out what my house is worth?

Fair market value is heavily dependent on the state of your local housing market, in addition to the factors listed above. When major improvements to the algorithm are made, we may recalculate historical Zestimates for affected homes. This provides you with the best estimate of historical property valuations. The Zestimate should not be used as the basis of any specific financial transaction because data sources may be incomplete or incorrect.

My home is located in one of the areas covered, so why isn’t there a Redfin Estimate for it?

The Zestimate is based on a complex and proprietary algorithm that incorporates millions of data points. The algorithm determines the approximate added value that an additional bedroom or bathroom contributes, though the amount of the change depends on many factors, including location and other home facts. Real estate professionals can also help their clients claim their home on Zillow, update the home facts and account for any work they have done on the property. A home’s Zillow listing is often the first impression for prospective buyers, and accurate information helps attract interest. Fees for an appraisal usually range between $300 to $500, but remember to do your due diligence when hiring an appraiser. An inaccurate appraisal could mean making important financial decisions concerning your home’s future using bad information.

How accurate are “zestimates” on Zillow?

Some areas have more detailed home information available — such as square footage and number of bedrooms or bathrooms — and other areas do not. Here is a guide to help you establish a baseline for what your house is worth. Checking a home valuation tool periodically can be helpful even if you’re not thinking of selling. There are three main types of home valuation, and all might assign slightly different dollar amounts to the same house. For example, the same home may have an assessed value of $300K, an appraised value of $395K and a fair market value of $400K.

How often will my Redfin Estimate change? How often is the Redfin Estimate updated?

It’s a question every homeowner wants to know the answer to, especially if you’re thinking about selling. However, for some homes we may not have enough data to provide a home valuation that meets our standards for accuracy. In these instances, we do not publish the Zestimate until more data can be obtained. It’s not possible to manually alter the Zestimate for a specific property. The Zestimate’s accuracy depends on location and the availability of data in an area.

Why isn’t the Redfin Estimate accurate for my home?

Zestimates for all homes update daily, but on rare occasions this schedule is interrupted by algorithmic changes or new analytical features. Check that your tax history and price history (the sale price and date you bought your home) are accurate on Zillow. Most understand that the Zestimate is an estimate of the value of a home, and that it should be used as a starting point. When combined with the guidance of real estate professionals, the Zestimate can help consumers make more informed financial decisions about their homes.

What Is My House Worth?

Ms. Witkowski has spent the last decade in Washington, D.C., reporting for publications including The Wall Street Journal, American Banker and Bankrate. This allows you to see how a home (or an area) has changed in value over time. The ultimate subreddit for everything a first time home buyer NEEDS to know.

What information is used to calculate the Redfin Estimate?

If your ultimate goal is to sell your property, a Realtor can help determine the value of your home and an accurate sales price. Our models can find neighborhoods similar to yours and use sales in those areas to extrapolate trends in your housing market. Our estimating method differs from that of a comparative market analysis completed by a real estate agent. We use data from a geographical area that is much larger than your neighborhood — in fact, we often use all the data in a county to help calculate the Zestimate. Though there may not be any recent sales in your neighborhood, even a few sales in the area allow us to extrapolate trends in the local housing market. Like other estimates, the Redfin Estimate is not a formal appraisal or substitute for the in-person expertise of a real estate agent or professional appraiser.

When all of this data meets the massive computing power of our proprietary machine-learning software and today’s best cloud technology, you get the Redfin Estimate. There are no guarantees that you’ll sell for the amount you see, but the results can give you a solid ballpark idea of your home’s approximate value. While the Zestimate is the estimated market value for an individual home, the Estimated Sale Range describes the range in which a sale price is predicted to fall, including low and high estimated values. For example, a Zestimate may be $260,503, while the Estimated Sale Range is $226,638 to $307,394. A wider range generally indicates a more uncertain Zestimate, which might be the result of unique home factors or less data available for the region or that particular home.

How Much is My House Worth? Free Home Value Estimator - Zillow Research

How Much is My House Worth? Free Home Value Estimator.

Posted: Sat, 26 Nov 2016 00:26:02 GMT [source]

This is what your property taxes are based on — the dollar value of your property as determined by your area’s local tax assessors. It can go up as your home appreciates in value, but it is typically lower than the amount the home could actually sell for. To get a federally guaranteed loan, a law called FIRREA (the Federal Institutions Reform, Recovery and Enforcement Act) requires you to get an appraisal from a professional appraiser. Lending professionals and institutions are prohibited from using other services when making any loan-related decisions. The Zestimate is intended to provide an estimate of the price that a home would fetch if sold for its full value, where the sale isn’t for partial ownership of the property or between family members. Our extensive analysis of foreclosure resale transactions supports the conclusion that these sales are generally made at substantial discounts compared to non-foreclosure sales.

Stay up to date on market changes and find out how much homes like yours have sold in the past year.

For example, knowing about how much your home has appreciated in value can help you determine how much equity you’ve built or whether you’re being overcharged for property taxes. The amount of data we have for your home and homes in your area directly affects the Zestimate’s accuracy. If the data is incorrect or incomplete, update your home facts — this may affect your Zestimate. The Zestimate® home valuation model is Zillow’s estimate of a home’s market value. The Zestimate incorporates public and user-submitted data, taking into account home facts, location and market conditions. Just like there are numerous external factors driving home values up, the same goes for when your home’s value declines.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

You may see more than one Zestimate for your address if you are a homeowner with multiple parcels of land. If you officially combine parcels, the county will send us updated information. To ensure the most accurate Zestimate, report all home updates to your local tax assessor. Unreported additions, updates and remodels aren’t reflected in the Zestimate.

If you’re thinking about selling your home, or just want to talk more about what it’s worth, we encourage you to contact a Redfin real estate agent at any time. Speaking with a Redfin Agent is free of charge, and there is no obligation to list your home for sale or work with Redfin. Determining how much your house is worth depends on a number of factors, and can fluctuate, up or down, throughout the years.

No comments:

Post a Comment